McKinsey's latest "Future of Health Survey" surveyed more than 5,000 consumers in the United States, the United Kingdom and China to explore five major trends in consumer health. This article will combine the survey results to analyze seven sub-fields of health, including healthy aging, weight management, gastrointestinal health, etc. Research shows that these areas all present high innovation potential and investment value.

【A-HED 】Support the future development of the health industry with science and data

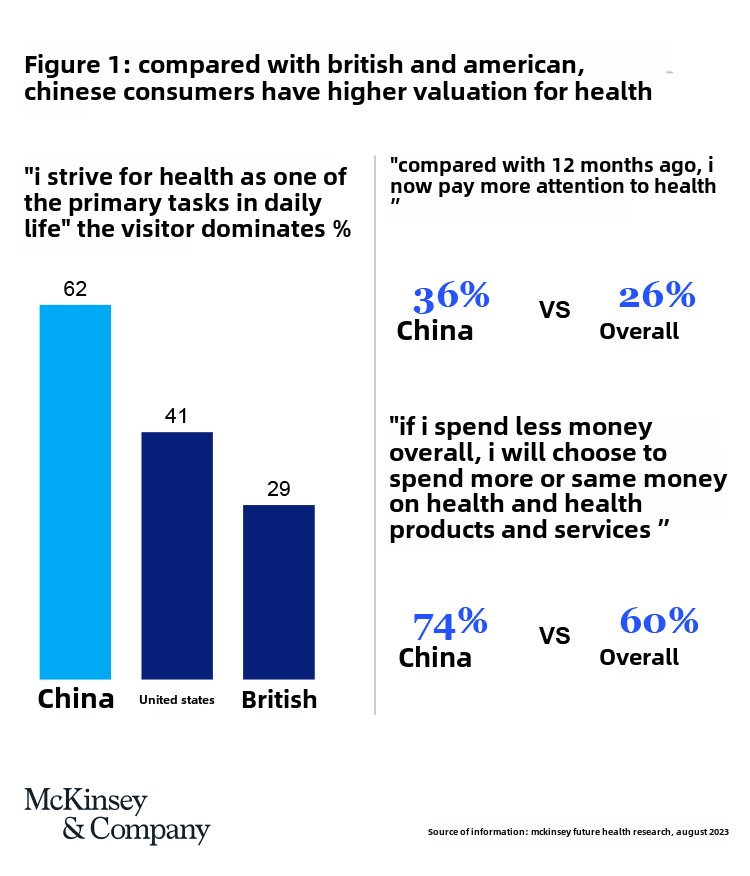

In China, 62% of consumers regard health as the top priority in daily life; this proportion is significantly higher than that in the United States (41%) and the United Kingdom (29%). Compared with a year ago, more Chinese consumers are paying more attention to health. What is even more noteworthy is that when asked whether they would adjust their health expenditures if the overall consumption level dropped, 74% of consumers answered that they would increase or increase their health-related expenditures (see Figure 1).

From the perspective of group segmentation, Generation Z and Millennial consumers are particularly concerned about health. They currently invest more in comprehensive health products and services than previous generations, covering various dimensions mentioned in our previous research, including health management, sleep improvement, diet and nutrition, physical fitness, scientific beauty care, and Psychological healing, etc. Consumer groups of different age groups also have different priorities (see Figure 2).

[A-HED] Five major trends in consumer health in 2024

How will consumers’ behavioral preferences in the health field change in 2024? The following five trends not only reflect their latest concerns, but are also consistent with what we have observed in previous research.

[B-HED] Trend 1: Health at home

The global COVID-19 pandemic has made at-home antigen self-testing products a household name. After the epidemic entered the normalization stage, consumers' attention to other types of home testing products continued to increase. For example, 26% of U.S. consumers want to be able to test for vitamin and mineral deficiencies at home, 24% want to be tested for colds and flu at home, and 23% want to be able to test cholesterol levels at home.

Home diagnostic testing provides a more convenient experience and meets consumers' needs for quick test results and high-frequency testing, so it is favored by consumers. 35% of Chinese consumers reported that they have begun to use home testing as an alternative to medical treatment, which is higher than that in the United States and the United Kingdom.

Despite growing interest in the field, some consumers still have reservations. In the United States and the United Kingdom, the main reasons include a preference for traditional medical treatment methods, a lack of perception of the need for such services, and price sensitivity; while in my country, about 30% of consumers are concerned about the accuracy of these testing technologies.

[B-HED] Trend 2: A new era of biomonitoring and wearable technology

About half of all respondents said they had purchased fitness wearable products. Although traditional wearable devices such as watches have been popular for a long time, the development of breakthrough technologies has led us into a new era with biometric monitoring at its core. For example, there are biometric smart rings equipped with sensors on the market today, which can provide users with analysis related to sleep quality through the accompanying mobile APP.

About one-third of wearable device users surveyed reported that they were using such devices more frequently than they were 12 months ago. More than three-quarters of all respondents expressed their intention to continue using wearable devices in the future. Based on this, we predict that as companies continue to expand the scope of monitoring health parameters, the application of wearable devices will become increasingly popular.

[B-HED] Trend 3: Generative AI helps personalization

Overall data shows that consumers’ preference for personalized health products has declined compared with previous years, but we believe this may be due to consumers becoming more picky when it comes to personalization.

Technological innovation and the rise of first-party data have created new possibilities for personalization and brought new opportunities. In the United Kingdom and the United States, about 20% of consumers expect to use biometric data to obtain personalized product and service recommendations. In China, this proportion has reached 30%. When such tools are combined with generative AI, the accuracy and customization of matching can be effectively improved. In fact, generative AI has penetrated into the wearable device and APP market, and some products will use generative AI to tailor exercise plans based on the user's fitness data.

[B-HED] Trend 4: Chinese consumers pay more attention to the clinical efficacy of products and natural and organic ingredients

In recent years, we have seen that global consumers’ focus on health products has begun to shift from “whether the ingredients are natural or organic” to “whether the product has clinical efficacy.” Today, the shift is even more pronounced. About half of consumers in the United States and the United Kingdom said that clinical efficacy is their primary consideration when purchasing products, while only about 20% of consumers listed "natural or organic ingredients" as their primary purchasing factor. This trend is most evident in categories such as over-the-counter medicines, vitamins, and dietary supplements. However, in China, consumers’ overall preference for clinically effective products and natural and organic products is roughly the same (see Figure 3), but there are some differences between different categories. They prioritize clinical efficacy when it comes to digestive medicines, topicals, and eye care products, while they prioritize naturalness when it comes to dietary supplements, superfoods (foods with health benefits and rich in nutrients), and personal care products. and organic ingredients (see Figure 4).

[B-HED] Trend 4: Chinese consumers pay more attention to the clinical efficacy of products and natural and organic ingredients

In recent years, we have seen that global consumers’ focus on health products has begun to shift from “whether the ingredients are natural or organic” to “whether the product has clinical efficacy.” Today, the shift is even more pronounced. About half of consumers in the United States and the United Kingdom said that clinical efficacy is their primary consideration when purchasing products, while only about 20% of consumers listed "natural or organic ingredients" as their primary purchasing factor. This trend is most evident in categories such as over-the-counter medicines, vitamins, and dietary supplements. However, in China, consumers’ overall preference for clinically effective products and natural and organic products is roughly the same (see Figure 3), but there are some differences between different categories. They prioritize clinical efficacy when it comes to digestive medicines, topicals, and eye care products, while they prioritize naturalness when it comes to dietary supplements, superfoods (foods with health benefits and rich in nutrients), and personal care products. and organic ingredients (see Figure 4).

[A-HED] Seven major growth points in the field of health

Our research found several clear areas of growth in global health. Increased consumer interest, technological breakthroughs, product innovation, and surge in chronic diseases have all catalyzed growth in these areas.

[B-HED] Women’s Health

Historically, women’s health needs have been poorly met and funding has been lacking. Today, purchases of all types of women's health products are on the rise. Although the proportion of respondents who purchase menstrual care and sexual health products is the highest, in terms of consumption amount, menopause and pregnancy-related products cost the most. Digital tools are also becoming increasingly common in women’s health. For example, wearable devices can track a user's menstrual cycle to determine the best time to conceive. Despite recent growth in the women's health field, there is still an unmet need for products and services. Menopause has been a particularly overlooked market segment: less than 5% of women’s tech startups are trying to address menopausal needs [1] .

[B-HED] Healthy Aging

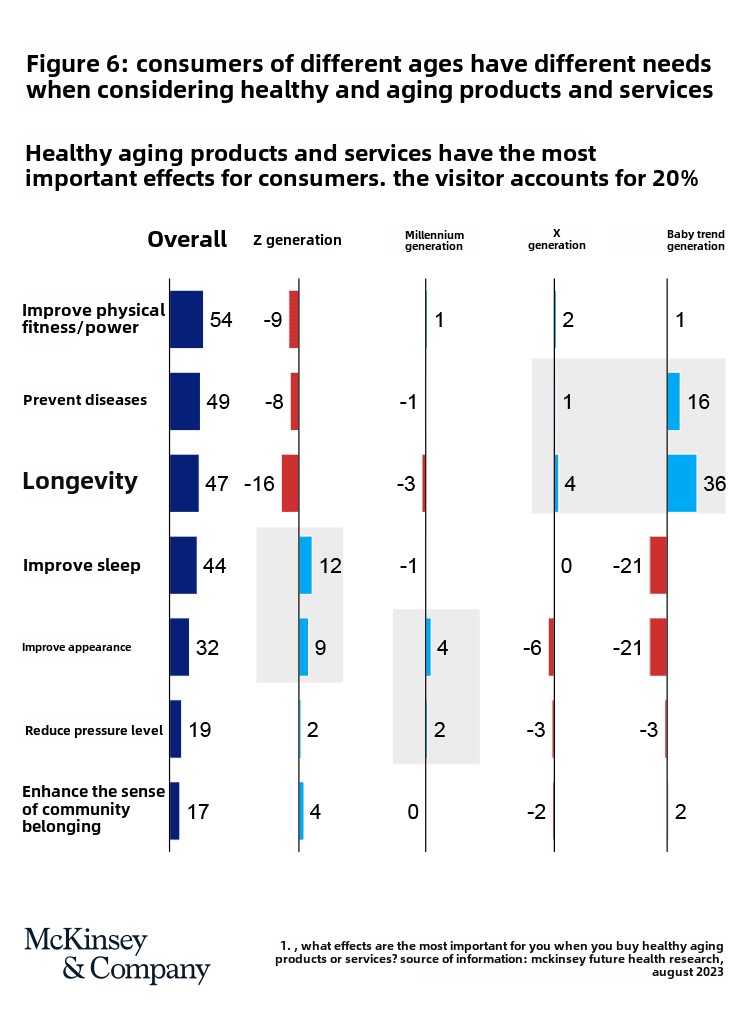

With the increasing popularity of preventive medicine, the gradual development of health technologies (such as telemedicine or digital health monitoring) and the continuous advancement of anti-aging research, people's demand for products and services related to healthy aging and longevity is also increasing. More than 60% of consumers surveyed believe that purchasing anti-aging and longevity-related products or services is “very” or “extremely” important. About 70% of British and American consumers and 85% of Chinese consumers said they purchased more such products in the past year than in previous years. The survey results are very similar across different age groups, indicating that the growth driver of healthy aging comes not only from the older generation who want to extend their lives, but also from the younger generation looking for preventive solutions. The difference is that the younger generation pays more attention to products that improve sleep quality, appearance and relieve stress, while the older generation focuses on disease prevention and longevity (see Figure 6).

As the population of advanced economies continues to age (by 2030, one in every six people in the world will be 60 years old or older [2] ), we expect that the world will pay more attention to healthy aging. To succeed in this market, companies should consider possible solutions holistically, taking into account mental health and social factors in addition to physical health. The key is to bring to market products and services that anticipate and meet consumer needs, rather than emphasizing the aging process just to sell products.

[B-HED] Weight Management

Weight management is a top concern for Americans. In the United States, almost one in three adults is obese [3] ; in our survey, 60% of American consumers said they are currently trying to lose weight. Although exercise is the weight management measure most cited by respondents, our research shows that more than 50% of U.S. consumers believe prescription drugs, including glucagon-like peptide-1 (GLP-1) drugs, are very effective of interventions. Other countries view prescription drugs slightly differently, with less than 30% of consumers in the UK and China believing drugs to be very effective for weight loss. The most commonly used and considered most effective methods by Chinese consumers are exercise and diet control. Given that the GLP-1 weight loss trend is still gaining momentum, the full picture of its impact on the overall consumer health and wellness market, particularly in China, is not yet known. As data emerges on drug adoption rates and impact on various product categories, companies should continue to focus on this area.

[B-HED] Offline fitness

For many consumers, fitness has evolved from a hobby to an essential daily activity: about 50% of American fitness professionals say that fitness is an important symbol of personal identity. Among younger consumers, the trend is even stronger: 56% of U.S. Gen Z consumers surveyed said fitness is a "top priority" in their lives (compared to just 40% of U.S. consumers overall). view). Offline fitness classes and personal trainers are the top two items on which consumers plan to increase spending. At the same time, consumers also plan to maintain spending levels on gym memberships and fitness apps. With increasingly abundant consumer choices, customer retention will also become a major test for fitness companies. Top-notch equipment, convenient location and business hours, membership system and referral incentives are just the basic requirements. Building strong communities, providing experiences such as outdoor activities, and launching nutritional guidance and personalized fitness programs (relying on generative AI) will help leading companies optimize their value propositions and reduce customer acquisition costs.

[B-HED] Gastrointestinal Health

More than 80% of consumers in the United States, the United Kingdom and China believe that gastrointestinal health is important, and more than 50% will pay more attention to gastrointestinal health in the next 2 to 3 years. In China and the United States, probiotic supplements are the most popular gastrointestinal health products, while British consumers prefer probiotic-rich foods (such as kimchi, kombucha, yogurt, etc.) and over-the-counter medicines. About 1/3 of American consumers, 1/3 of British consumers and half of Chinese consumers said (see Figure 7) that they hope there will be more gastrointestinal health products on the market. With the growing interest in consumption, home intestinal flora testing and personalized nutrition programs are expected to become new consumption fronts.

[B-HED] Sexual Health

The destigmatization of sex, the popularization of sex education, and the focus on women's sexual health have all contributed to the growth in demand for sexual health products. Last year, 87% of American consumers said that their consumption of sexual health products was the same or increased compared with the previous year, and the frequency of purchasing products such as human lubricants, contraceptives, and adult toys also increased simultaneously. During the COVID-19 pandemic, more and more companies are selling sexual health products online. At the same time, traditional pharmacies, beauty retail, department stores and other retail companies are also introducing more sexual health brands and products in their stores. Emerging brands can take this opportunity to increase marketing and distribution efforts to reach new customers and expand scale.

[B-HED] Sleep health

Although it has been rated as the second most important health priority for consumers year after year, sleep is still the area with the most unmet consumer needs. Our last report showed that 37% of U.S. consumers and 68% of Chinese consumers want more sleep-aid products and services to improve cognitive function, relieve stress, manage anxiety, etc. In the year since, little has changed. One of the key challenges in improving sleep is that sleep quality is affected by multiple factors such as diet, exercise habits, coffee consumption, screen time, stress levels, and other lifestyle factors. Therefore, there are few technology companies or emerging brands in the sleep field that can create an effective ecosystem and comprehensively improve consumers' sleep quality. Using consumer data to effectively solve sleep disorders, such as assisting sleep, reducing easy and early awakening, and improving sleep quality, will become opportunities for major companies.

— Consumers are taking the initiative to take control of their personal health and are seeking data-enabled, cost-effective products and services. Companies that can help consumers interpret data and provide personalized, targeted scientific solutions will be successful.

About the author:

He Jingyi is a global managing partner of McKinsey and Company, based in the Shanghai branch; Daren Hsu is a global managing partner of McKinsey and Company, based in the Hong Kong office; Chen Xi is a senior knowledge expert at McKinsey, based in the Shanghai branch; Jonathan Medalsy is an associate partner in McKinsey's New York office.

The author thanks Shaun Callaghan, Hayley Doner, Anna Pione, and Ray Liu for their contributions and help with this article.

[1] https://www.axios.com/2022/11/23/the-growing-menopause-at-work-market .

[2] World Health Organization: WHO .

[3] https://www.cdc.gov/nccdphp/dnpao/docs/Obesity-Fact-Sheet-508.pdf.